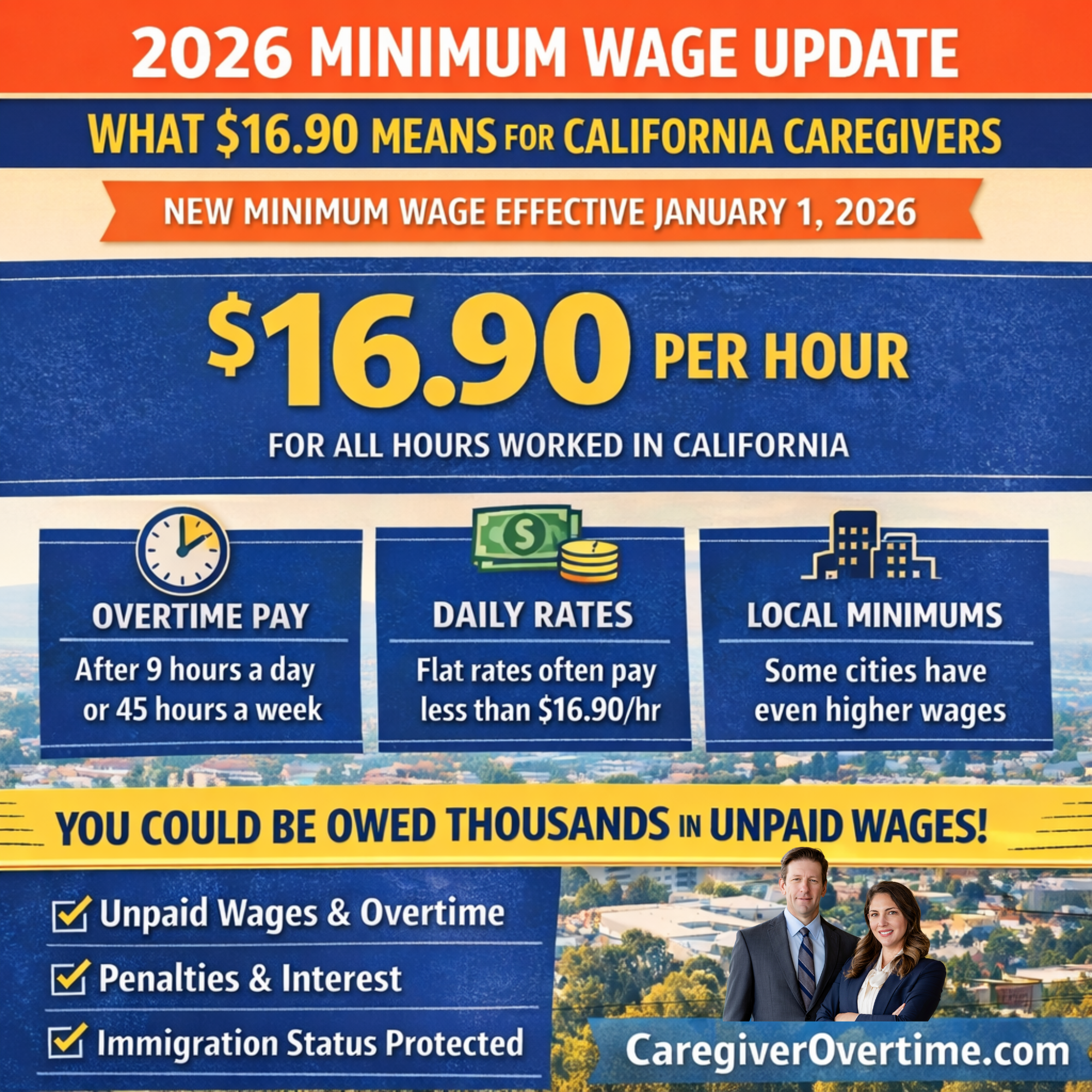

2026 Minimum Wage Update: What $16.90 Means for California Caregivers

As we enter 2026, California’s wage laws are changing in ways that directly affect caregivers across the state. Starting January 1, 2026, the **statewide minimum wage increases to $16.90 per hour for all employees who are not covered by higher local wage laws. This includes domestic workers and caregivers — whether you’re paid by the hour, by the day, or through a flat rate. CalDIR

For many caregivers, this wage increase may mean something you’ve long deserved: you could be owed unpaid wages if your employer has not been paying you at least the new legal minimum or providing required overtime.

Why $16.90 Matters for Caregivers

Minimum wage isn’t just a number — it’s the legal baseline that every employer must meet for each hour you work. Under California law:

Employers must pay you at least $16.90 per hour for every hour worked, unless a local law requires an even higher rate. CalDIR

Many cities (like Los Angeles, San Francisco, and others) have minimum wages above $16.90 — and employers must pay the higher applicable rate. Wikipedia

Caregivers often work long shifts, sometimes 24 hours or more. When you break down flat daily pay or salary into an hourly wage, many caregivers are paid well below the law requires — even after the 2026 increase.

California’s Domestic Worker Bill of Rights Still Applies

The Domestic Worker Bill of Rights (DWBR) still stands strong in 2026, ensuring that most caregivers are entitled to:

Minimum wage for every hour worked; and

Overtime pay — at one and one-half times your regular rate — when you work more than 9 hours in a day or 45 hours in a week. CalDIR

These protections were created because caregivers historically were excluded from wage laws that covered other workers. Without this law, many caregivers would have little to no guarantee of fair pay.

How Wage Violations Happen in Caregiving

Here are common ways caregivers get underpaid — even under the new $16.90 minimum wage:

🔹 Flat Daily Rates

An employer might pay a set amount per day — for example, $180 or $200 — regardless of how many hours you work. When divided by the actual number of hours worked, this often amounts to below $16.90 per hour.

🔹 24-Hour Shifts Without Overtime

Even if you’re in the same place for 24 hours, the law counts hours worked. A flat “24-hour rate” often doesn’t pay sufficient minimum wage or overtime.

🔹 Local Minimum Wages Are Higher

Some cities require minimum wages above $16.90. If your work is in one of those cities, employers must pay the local rate. Wikipedia

If you’ve earned less than the correct minimum wage or missed overtime, you may have a valuable wage claim.

What You May Be Owed

Under California wage law, if you were underpaid:

You can recover unpaid wages dating back several years

Employers may owe interest and penalties

You don’t have to pay upfront legal fees for a case review

Importantly, your rights to unpaid wages do not depend on your immigration status — undocumented workers are protected under California law. If your employer tries to use your status against you, that’s illegal.

Action Steps for Caregivers

Here’s what you should do if you think you’re owed:

Track your hours — Write down start and stop times every day.

Collect pay records — Pay stubs, bank transfers, daily rate notes.

Compare to $16.90/hour — Even before overtime, your average hourly rate must meet or exceed this new threshold.

Reach out for a free legal review — We can help you understand whether you have a claim.

We’re Here to Help

At CaregiverOvertime.com, we specialize in helping caregivers enforce their wage rights. Over the years, we’ve helped caregivers recover:

💰 Over $70 Million in Unpaid Wages

Our goal is simple: make sure caregivers are paid what the law requires — including the new 2026 minimum wage and proper overtime. Whether you work in-home, live-in, or in a facility, you deserve fair pay for your hard work.

Your Rights Still Matter in 2026

This minimum wage increase is more than a number — it’s a reminder that caregivers deserve to be paid fairly for every hour worked. If your employer isn’t paying you at least $16.90 per hour plus required overtime based on your actual hours, you may be owed compensation.

Contact Us for a free, confidential consultation and find out if you’re owed unpaid wages under the 2026 minimum wage law.